Symmetry Partners

Alpha Vee

Workstation Case Study

Building on Momentum: Alpha Vee Workstation Helps Symmetry Partners Develop Unique SMA Strategies

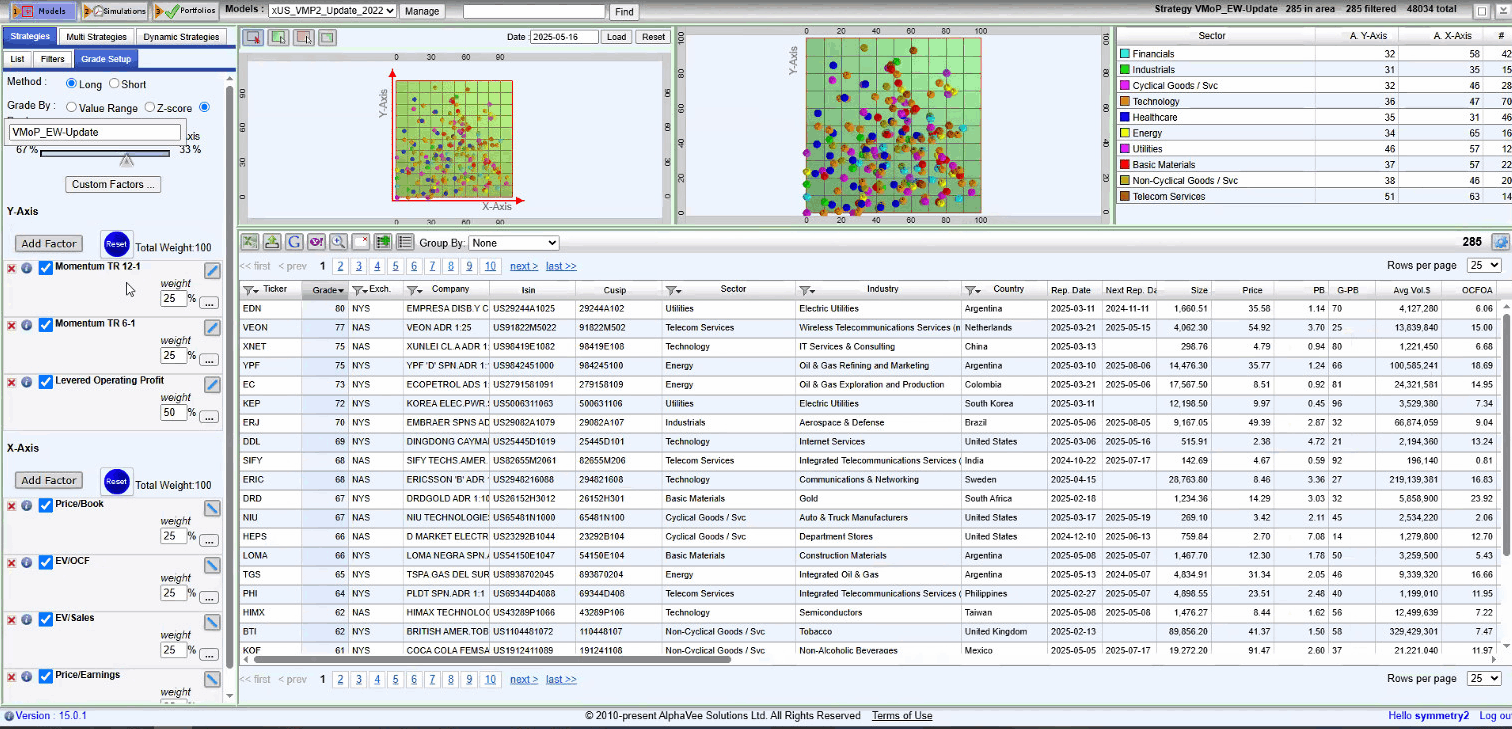

Symmetry Partners used Alpha Vee Workstation’s extensive fundamental and momentum factor analytical capabilities to build its multi-factor SMA portfolio.

Investment advisers and asset managers that want to bring new strategies and products to market often face a daunting challenge: Developing efficient processes for testing their investment ideas and gathering the historical fundamental and pricing data needed to run this analysis.

Symmetry Partners was one of these companies. Based in Glastonbury, Connecticut, this investment advisory firm manages close to $6 billion in assets under management (as of 12/31/2024) invested in their family of mutual funds and separately managed account (SMA) strategies.

Symmetry is an evidence-based quantitative manager that builds portfolios based on fundamental factors that have been validated through decades of academic research.

In the past, Symmetry’s Chief Investment Strategist, John McDermott, often had to conduct much of this research manually, gathering pricing data from different sources and writing code to analyze securities and run portfolio analytics.

He knew there had to be a faster and easier way to conduct these tasks. So, after he and the Symmetry team evaluated several analytical platforms, they chose Alpha Vee Workstation.

“Alpha Vee Workstation stood out as a great tool for systematically evaluating, selecting and weighting stocks for a portfolio based on fundamental factors and doing this on a fairly real-time basis,” says McDermott.

“It’s also become an important tool to help us validate and refine various investment ideas. With access to pricing data dating back to 2000, an extensive range of built-in factor analysis capabilities, and the flexibility to add customized measures, the platform allows us to fully back-test a broad investment thesis and bring it down to an implementable portfolio.”

Building a New Sector-Based SMA Strategy

Symmetry initially used Alpha Vee Workstation to help generate buy lists of securities for use in various SMA models, including a multi-factor portfolio that focused on value, momentum and quality.

More recently, McDermott used Alpha Vee Workstation to support the refinement of an existing strategy: A sector-based momentum SMA strategy.

Why sectors?

“Academic research has proven that a great deal of momentum in individual stocks can be explained by momentum measures in their specific industry,” he says.

To identify these momentum factors, McDermott had been manually conducting his research by importing pricing data from several platforms and entering it into spreadsheets.

Alpha Vee Workstation proved its value as a tool for conducting momentum analysis on individual stocks. Now McDermott hoped the platform could also be used to conduct similar analysis at the sector level.

The core platform didn’t have the desired momentum measures built in. So Symmetry worked with Alpha Vee to develop a customized set of functions that now give Symmetry a great deal of flexibility for testing various sector momentum strategies.

“We’ve used these new functions to run many different momentum signal simulations. These simulations enabled us to rank sectors based on different momentum-factor signals and show the hypothetical impact of different weightings and rebalancing periods,” says McDermott.

Symmetry also used Alpha Vee Workstation to run historical performance simulations of portfolios comprised of various combinations of sectors. Using up to 20 years of built-in pricing data, this analysis provided hypothetical active returns, correlations with the S&P 500, beta, Sharpe and Sortino ratios and many other performance metrics.

Overall, McDermott gives Alpha Vee Workstation and the Alpha Vee team his seal of approval.

“Alpha Vee Workstation has significantly improved the productivity of Symmetry’s investment strategy team, making it easier to conduct analysis and vet investment theses before taking them to market. And one of the nicest things about working with Alpha Vee is their willingness to work with clients to enhance the platform to meet their specific needs."

Alpha Vee Workstation provides extensive tools to help investment advisers and asset managers test-drive various investment ideas, run portfolio analytics, screen securities and back-test using more than 20 years or pricing data on more than 45,000 global securities.

Symmetry Partners, LLC (“Symmetry”) is an investment advisory firm registered with the Securities and Exchange Commission. The firm only transacts business in states where it is properly registered or excluded or exempted from registration requirements. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. The information here is provided for general information purposes only and should not be considered a recommendation or personalized investment advice. Symmetry is not affiliated with Alpha Vee.

About

Integrated software & Investment strategies for professionals. Spend more time finding ideas that generate alpha.

Terms Of Use and Risk DisclosuresDisclosure: Investing contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.