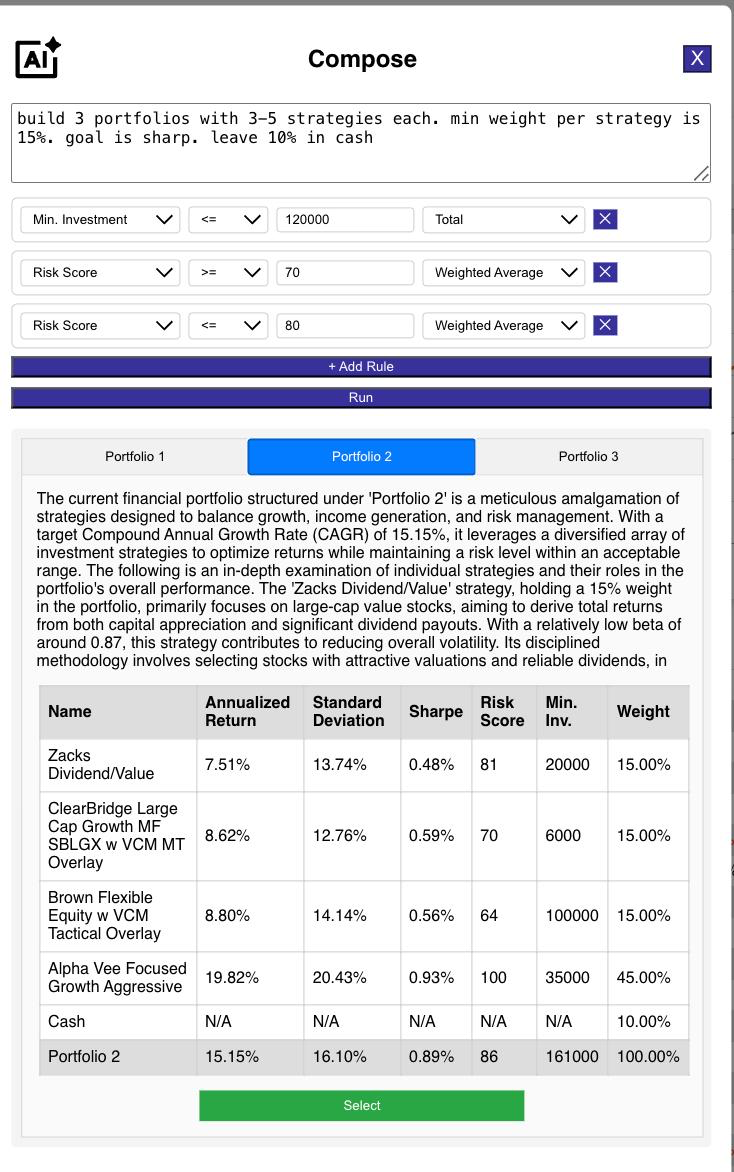

Leverage AI to create personalized portfolio options within risk and investment constraints for each client.

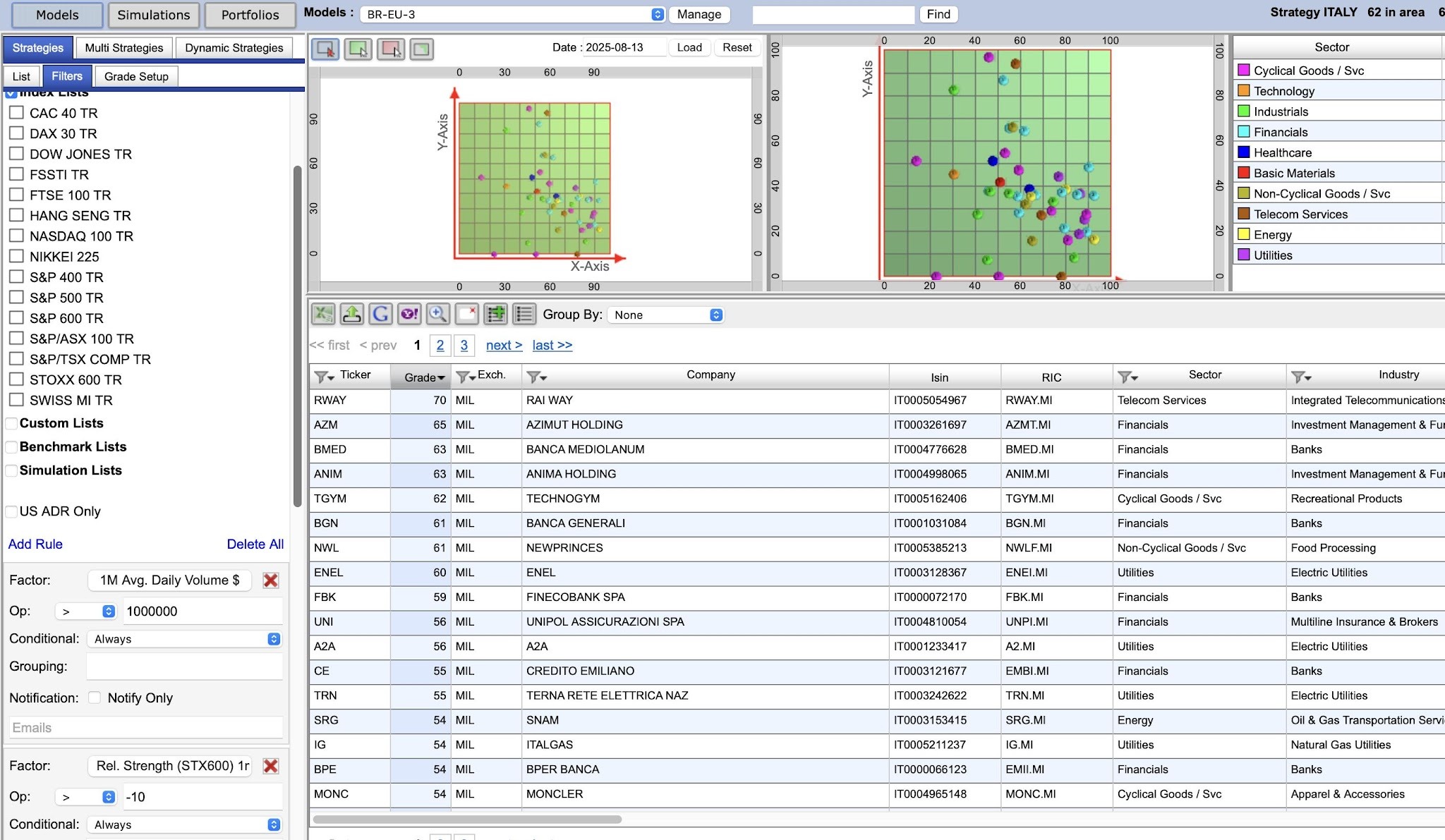

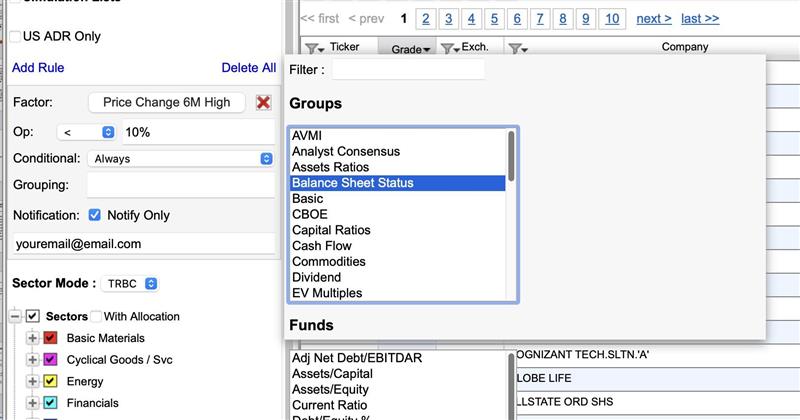

Quickly select and manage thousands of equities, ETFs, and funds with powerful filters.

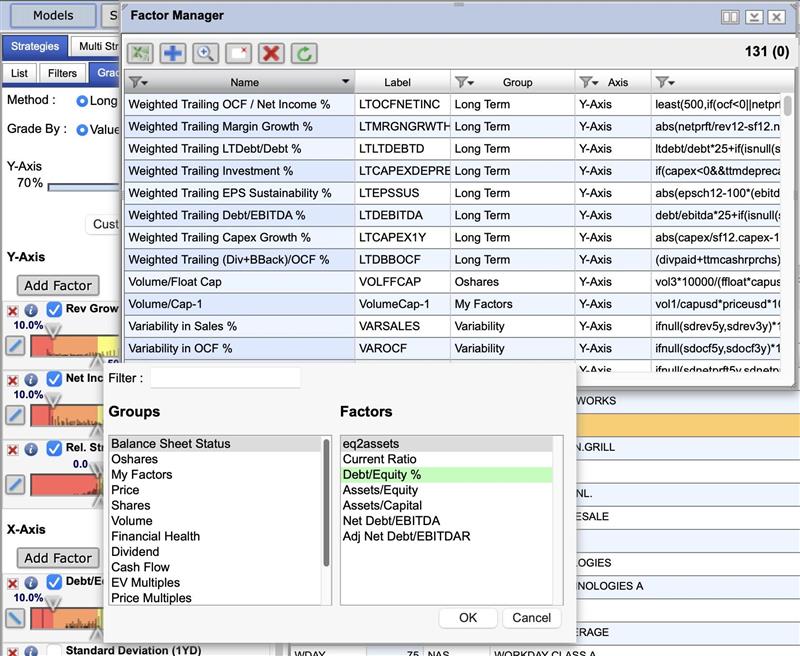

Design, test, and track custom factors with full transparency, flexibility, and consistency to enhance research and strategy performance.

Stay informed with real-time alerts on prices, technicals, valuations and your portfolios via email or mobile push.

Unify analytics and research in one platform to simplify portfolio evaluation and make smarter, faster decisions.

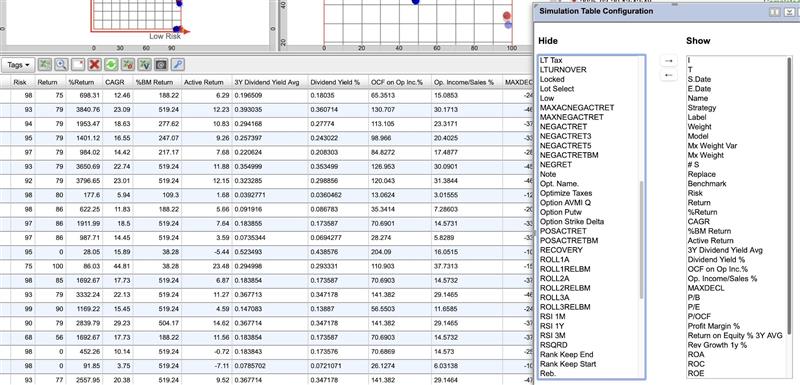

Test strategies with institutional rigor and flexible simulations to validate ideas and manage risk confidently.

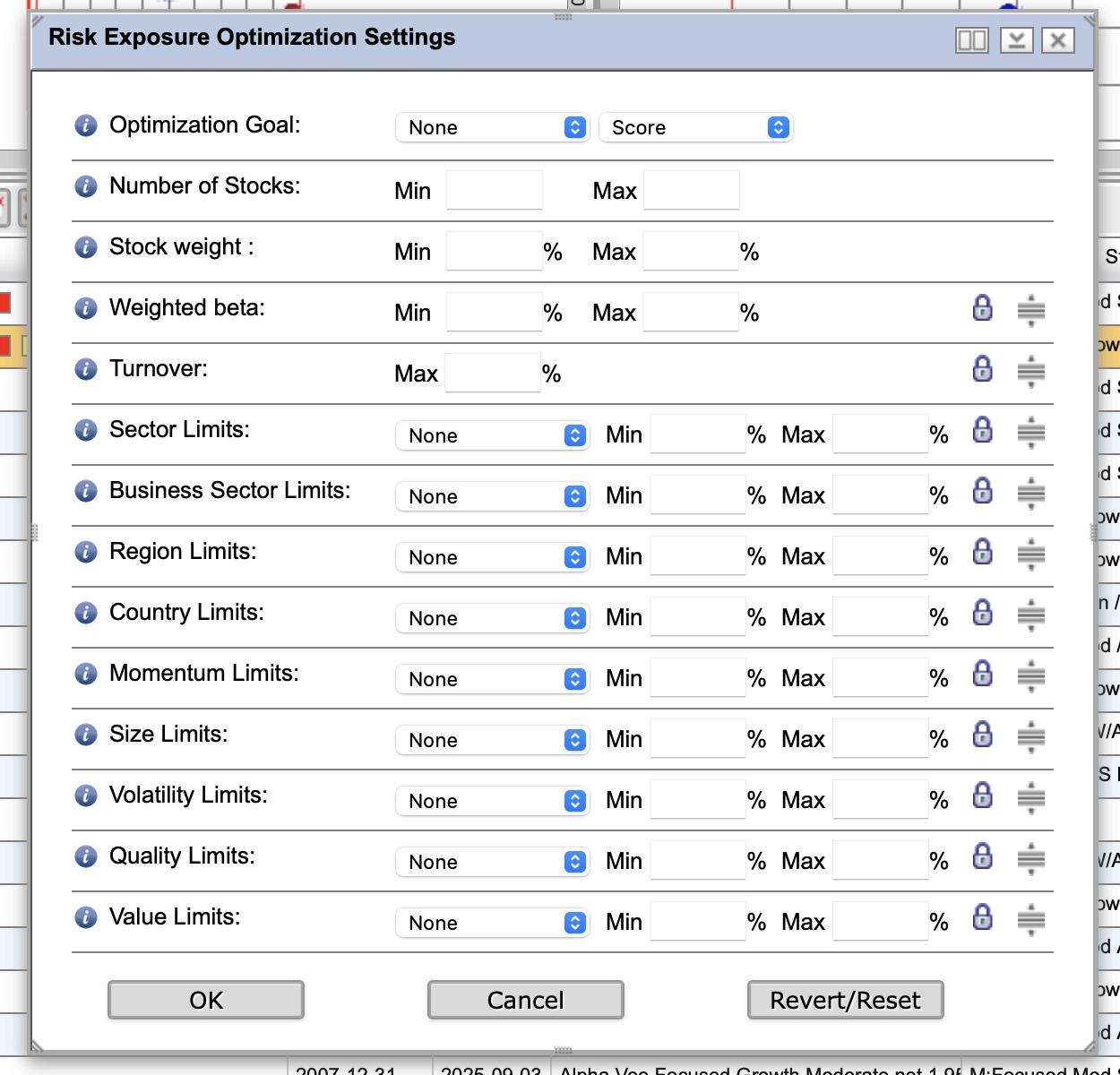

Build dynamically optimized portfolios that balance growth, risk, and client goals using advanced, intuitive tools.

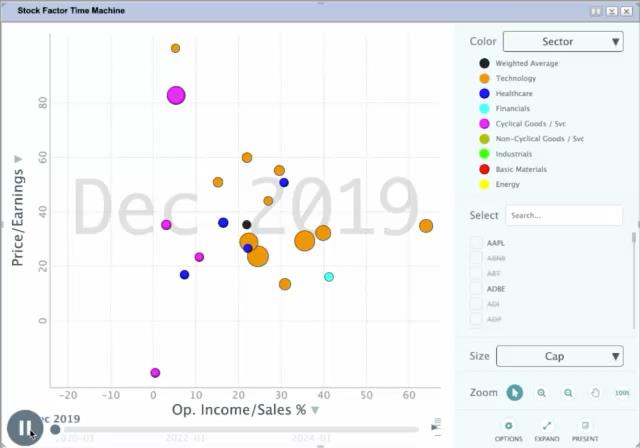

Track factor exposures over time to reveal patterns, manage risk, and make forward-looking investment decisions.

Gain transparent, granular insights into portfolio performance to identify drivers, refine strategies, and build client trust.

Design custom, forward-looking risk models to enhance oversight, tailor strategies, and manage exposures effectively.

Integrate tax-aware optimization into portfolios to maximize after-tax returns and improve investment efficiency.

Automatically generate accurate, up-to-date fact sheets to reduce errors, save time, and scale communications.

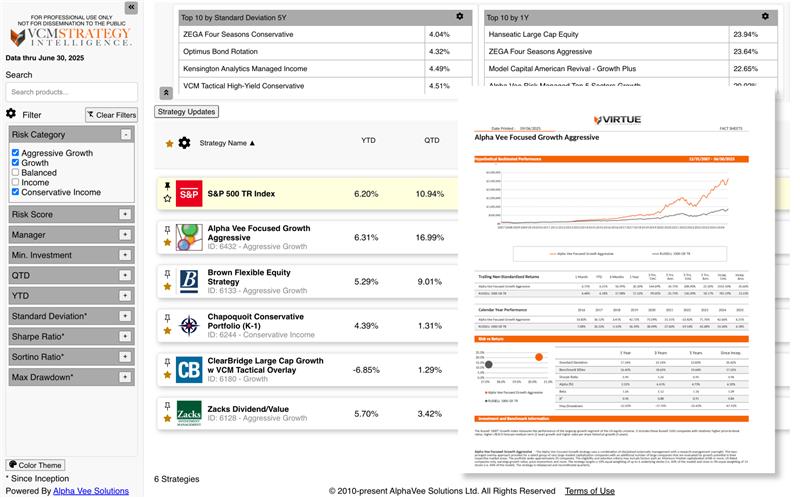

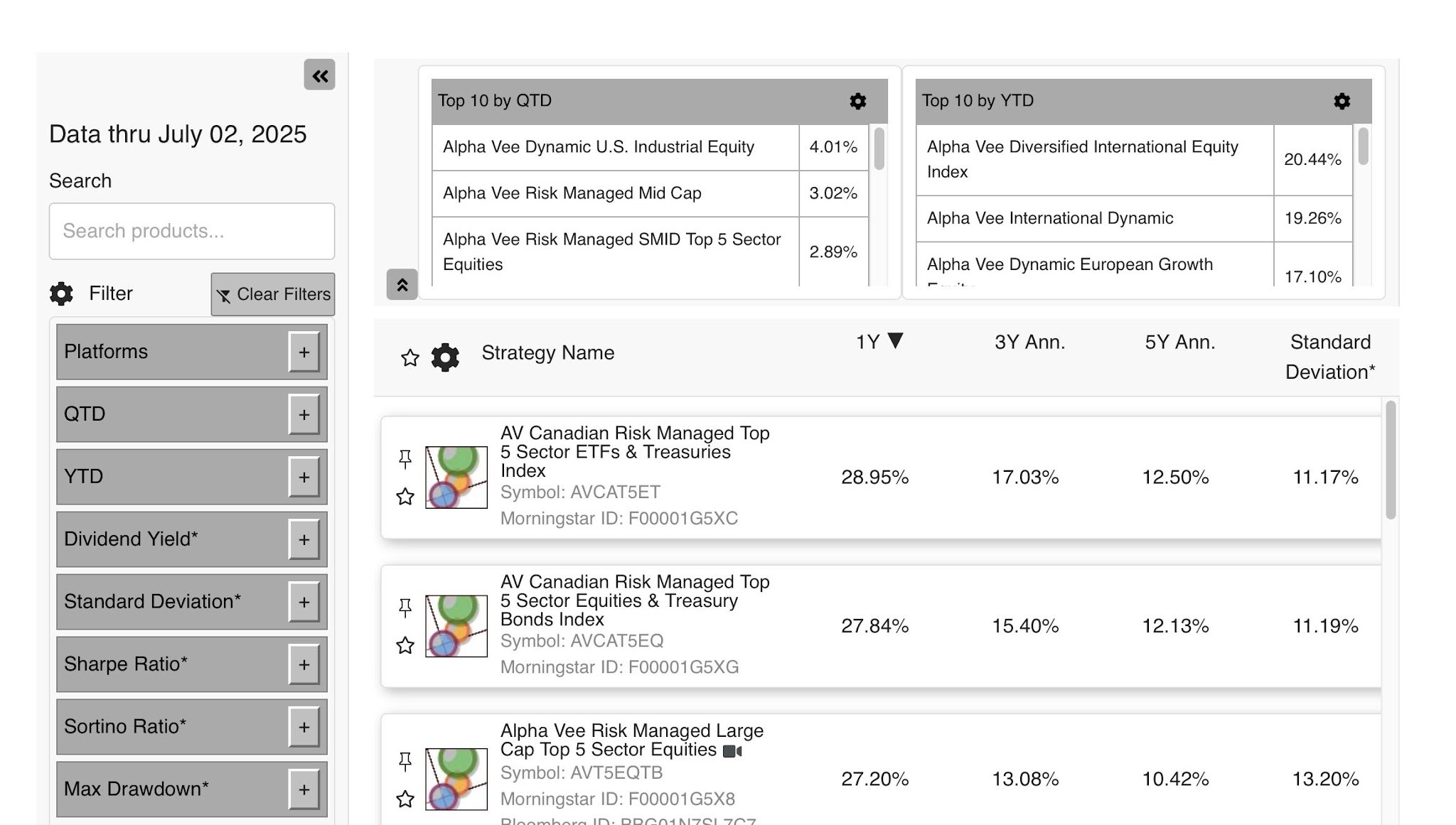

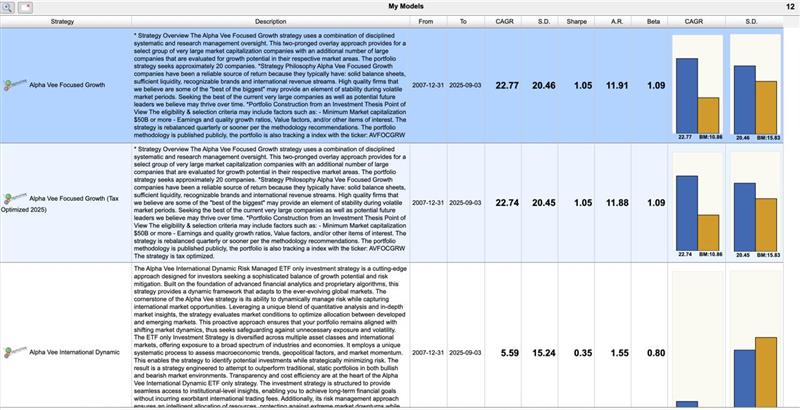

Access real-time stats, organize materials, and subscribe to favorite strategies with a clean, centralized dashboard.

Provide clients secure, interactive access to portfolios, analytics, and reports for timely, transparent communication.

Seamlessly integrate analytics, simulations, and optimizers into your platforms to eliminate silos and boost efficiency.

In addition to providing software, we can handle operations and trading to let you focus on clients.

One of three winners in Wealthtech Firm of the Year category

One of three winners in Wealthtech Firm of the Year category

One of three winners in Wealthtech Firm of the Year category

One of three winners in Wealthtech Firm of the Year category

Alpha Vee combines deep industry expertise with actionable insights to help you overcome challenges, save money, and drive business growth. Our integrated software and investment strategies let you focus on alpha-generating ideas and serving your clients.