Start Free Trial Now !

45,000 global securities, Point-in-time history with ratios, hundreds of factors,

aggregates, EOD Pricing, and more.

Intuitive tools for ranking systems, screens, risk vs. return analytics, and an automated trading system.

Ability to backtest using your real-world assumptions.

Retail investors making investment decisions for personal accounts and/or those of direct dependents

Users managing equity assets as part of a regular course of business

Users creating research as part of a regular course of business

Professors, Students, and Educational institutions classroom usage

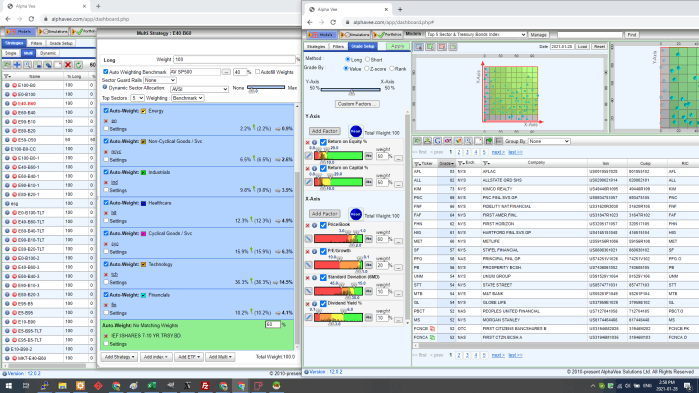

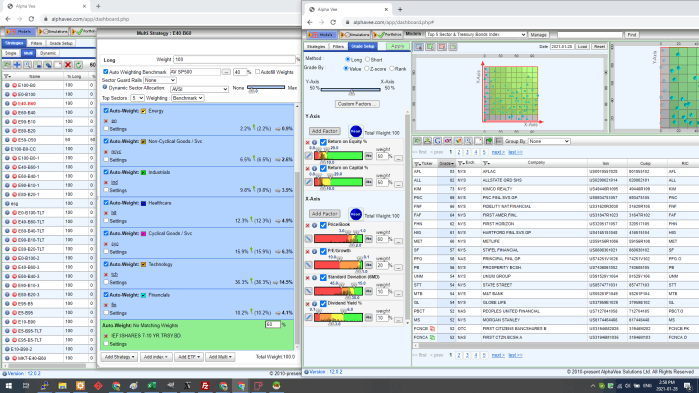

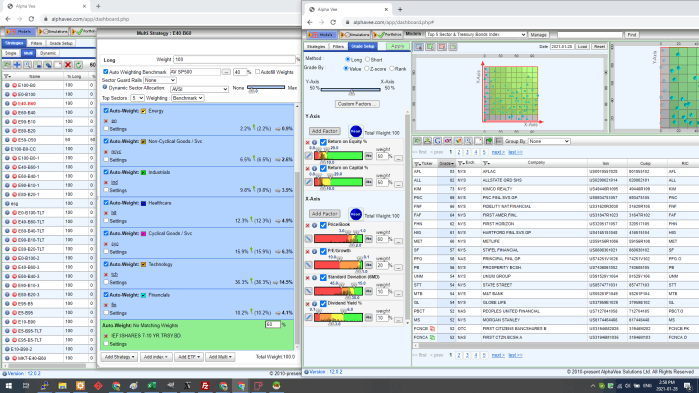

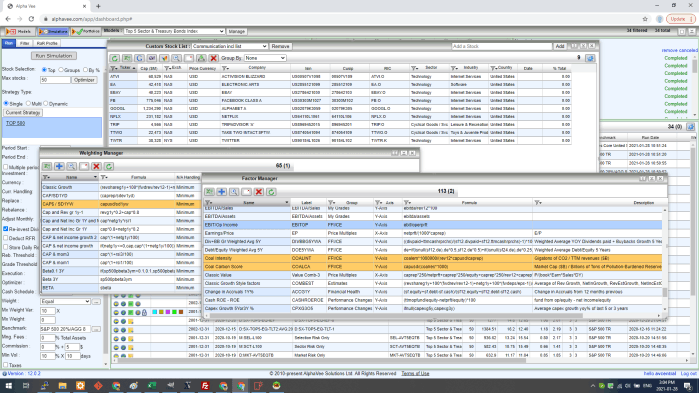

Graphically view and model the Global equity Market to filter your investment universe by cap size, sector, industry, sub sector, currency and exchanges. Ability to use any combination of hundreds of pre-defined, yet adjustable, factors for growth and value, absolute and/or relative modes, and determine the percentage criteria for each factor to build a valuation formula. Ability to create Global equity investment models on almost a near infinite combination of generic (or proprietary) indicators / factors. This also includes the ability to research each stock individually and all of the fundamental data going back 20+ years. Includes thousands of world stocks with all their fundamentals, prices, dividends, and liquidity history. Ability to create global equity investment models on almost a near infinite combination of generic and proprietary factors.

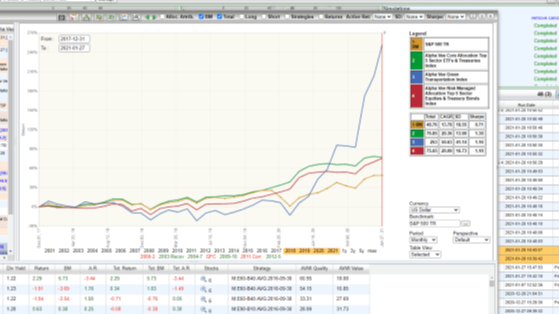

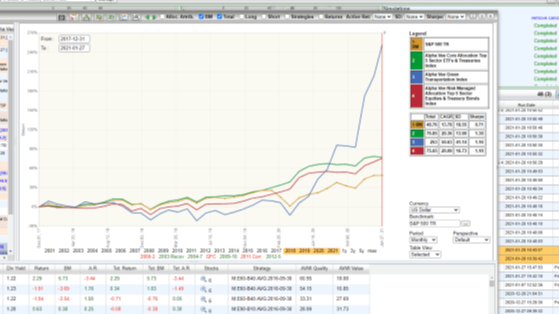

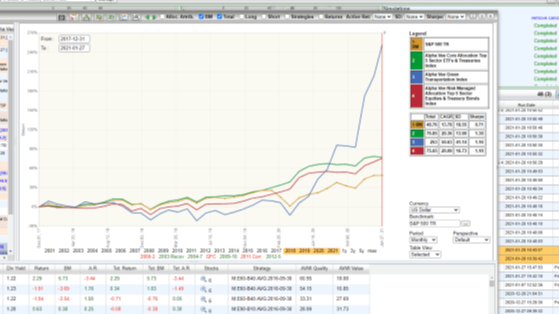

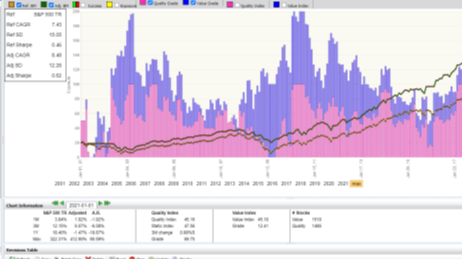

The Simulation Engine is capable of back testing up to 20+ years in a few minutes on average. The user is able to define the simulation parameters: optimization targets and constraints, number of stocks, fixed or max based on quality, investment amount, currency, weighting, and more.

Fully transparent trade log and P&L through simulation run, and full analysis of risk and return attribution. Easily exportable to the industries leading risk model providers. Ability to back test single, multi and dynamic strategies and compare multiple simulations to one another. Automated reporting of every simulation may be customized by the user

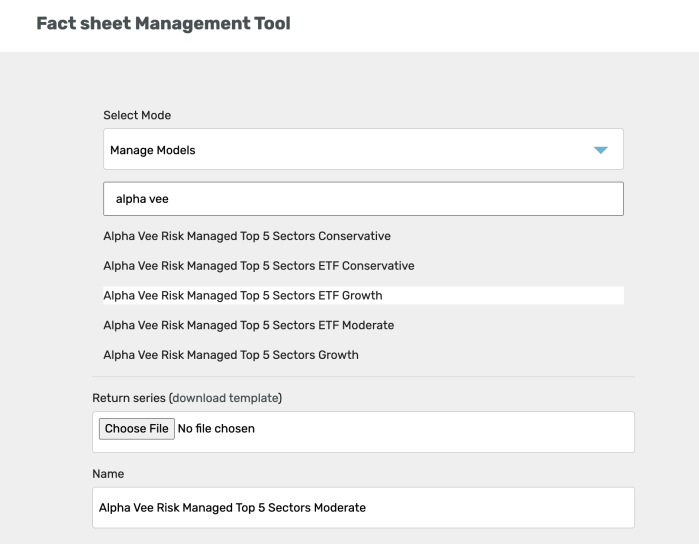

Streamline your financial product presentations with our automated software for generating fact sheets. Save time and reduce errors by instantly creating accurate, professional documents that meet compliance standards. Enhance client trust with up-to-date, personalized information, and free your team to focus on sales and customer engagement. Experience efficiency and reliability in every fact sheet—because your clients deserve the best, and your business deserves simplicity

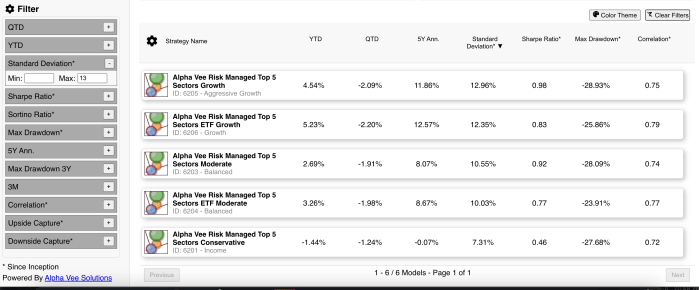

Gain a competitive edge with our automated financial product dashboard. Access a comprehensive list of financial models from a wide range of managers, complete with ongoing performance statistics, disclosure statements, support documentation videos and more. Easily and securely review, compare or evaluate manager performance from any web browser, ensuring you have the most up-to-date insights at your fingertips. Enhance decision-making, streamline operations, and stay ahead of the market with real-time data and analytics—anytime, anywhere. Available for simple web application integration and white labeling.

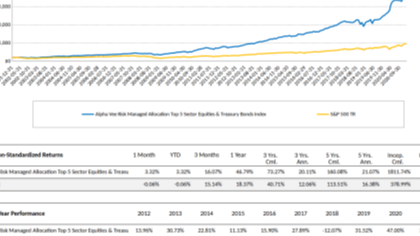

Our software can automatically generate customized reports and fact-sheets by merging the model and simulation data with an excel template that defines the look and feel of the report.

All the data collected by the simulation engine is used to populate graphical charts and tables in the template which can be exported to multiple formats such as PDF, HTML and XLSX.

Alpha Vee provides advanced users the ability to use their own proprietary custom data, equity universes and factors in order to make full use of the platform capabilities with their own data.

Users can create their own customized factors using the Custom Grade option in Grade Set Up. The user can choose a combination of factors from the underlying data and apply math operations. Very easy to use and does not require programming and is graphically oriented.

Custom universes can be created and populated by importing a list of equities from a csv or excel file and managed in the system through the Custom Lists Manager option.

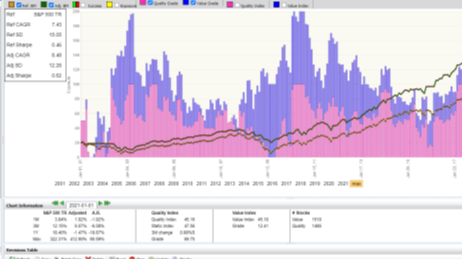

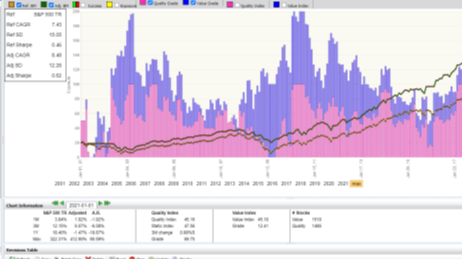

This unique technology and investment capability is used to create custom market indicators by aggregating data from a large universe optionally combined with custom data fields and monitoring that data to determine the market score at any point in time.

Define your universe (e.g. economic sector, geography, etc ...) by using the various filtering options, setup how to score and aggregate the universe and how to normalize that into a score between 0 to 100.

The portfolio manager allows the user to run continuous portfolio management based on the predefined investment model and simulation parameters. All back test rules and assumptions are converted and applied to ensure proper go forward stock selection and trade execution. The option to rebalance is available monthly, quarterly, semi annual, annually, bi annual or can be adjusted by the user. Every day the Growth, Value and Grade rankings are updated. The user can also export/import trades that are made into the portfolio, manually adjust transactions, and input option trades. All charts, P&L, trade instructions are fully transparent.

users can load a pre-existing portfolio or trade log into the system to grade that portfolio, review statistical exposure of the portfolio, and/or use going forward in portfolio management.